Guest contributor Nick Eubanks shows you how to get started using keyword analysis to find new opportunities in untapped niche markets.

A vertical market is defined as a group of similar businesses and customers that engage in trade based on specific and specialized needs. Often, participants in a vertical market are very limited to a subset of a larger industry (a niche market). (Wikipedia)

This is a crucial concept when seeking to leverage SEO as a revenue driver for your business.

Search engine optimization all boils down to your keyword list, and if your keywords are not accurately targeting your vertical markets you are missing out on a lot of revenue. Effectively identifying the keyword phrases that allow you to grow and sustain your online business directly correlates to your success.

Considering that effective keyword identification and detailed analysis are two of the most critical factors in SEO, it surprises me that many SEO professionals do not take it upon themselves to become trained in the science of keyword analysis.

When used to evaluate business drivers, keyword analysis can provide massive visibility into an industry and the opportunities that lie therein.

In order to get a handle on vertical markets, I think it is first important to understand the main competitive differences between offline and online business.

Industries vs. vertical markets

An industry is an all-encompassing marketplace where businesses compete head to head on large-scale competitive factors like location, distribution channels, shipping and lead times, taxes, manufacturing costs, etc.

A vertical market is a microcosm of an industry or a niche: representative of one set of products or services where the consumer demand is specialized. Niches exist within brick-and-mortar industries as well but do not really allow for manufacturers or distributors to specialize their inventory to the extent that is possible through ecommerce.

For example, let’s take a look at the food industry. Food as an industry is separated a many different ways: from packaged goods versus made-to-order, and even more often by cuisine (e.g. Mexican, Thai, Italian). If we look at a segment within one of these food categories the vertical markets quickly emerge:

- Instead of competing in the massive Italian food industry, one could specialize in a vertical market like organic olive oil.

- Instead of Mexican food as a whole, an online retailer can specialize in tamarind candy.

- Instead of Thai food, an online business could specialize in Thai iced tea.

Do you think a brick-and-mortar store selling only Mexican tamarind candies, Thai iced tea, or organic olive oil would last very long? It’s possible, but if so it is going to be due to a combination of the contributing factors that provide competitive advantage for offline businesses. Things like:

- Location

Is it located at an airport or port of call? Is it located somewhere geographically specialized in selling the product (e.g. in the case of olive oil this could be an Italian city in a region known for olive oil, or in a “Little Italy” in another country)? - Distribution channels

Do they distribute at any national specialty chains such as restaurants or grocery stores? Are they a sponsor of a cooking show or product? Is the product featured in a popular shopping medium such as a recipe? - Shipping and lead times

Can they cater to impulse or short-term shoppers requiring expedited shipping? Do they maintain sufficient inventory to support large orders or spikes in demand without forcing the buyer to wait several weeks for production and transit? - Taxes

Are they in a heavily regulated (and therefore taxed) industry such as alcohol? Do they need to price higher than online competitors to cover taxes on physical goods?

Advantages of online retail

All of these constraints offer large advantages to online retailers versus traditional brick-and-mortar stores.

To take this a step further, let’s look at an industry that offers less individual specialization but due to the emergence of vertical markets has been forced to operate almost entirely online: the software industry.

When you think of physical places that sell software what comes to mind? I immediately think of Best Buy, Apple, and the small one-off local computer stores. These are industry stores that stock and sell categories of products, comprised of vertical markets like accounting software, business applications, publishing, imaging, gaming, etc.

The distinction between vertical markets versus industries is an important concept to grasp when exploring keyword analysis for SEO. If you are going to leverage SEO for your business, you need to be aware of your vertical markets, your market competitors, and the associated costs and projected revenues within your space.

What is keyword analysis?

In its simplest form, keyword analysis is a method for identifying vertical markets.

If you approach keyword analysis seeking the right information, you can offset large amounts of risk by gaining visibility into things like:

- the potential size of the customer base

- the average selling price

- an estimate of monthly revenue given x amount of traffic and an average conversion rate.

How do you do this?

Let’s start with the data that we can easily acquire and work towards the assumptions.

First, let’s assess the size of the potential customer base by taking a look at the exact monthly search volume for a set of target keywords within an individual geographic market.

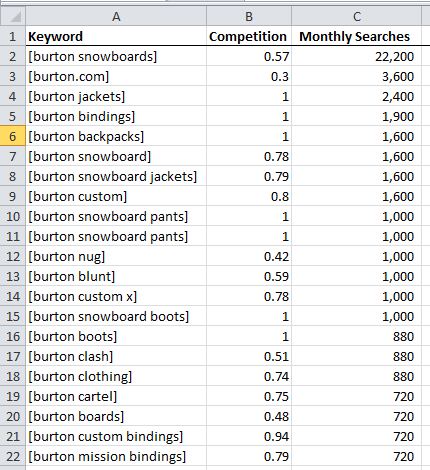

For this example, let’s look at search volume for Burton snowboards and apparel in the U.S.

So based on the above (short) keyword list of 20 keywords, the total monthly estimated search volume is 47,020. This is roughly your gross potential customer base.

Next, let’s look at the average selling price for one associated product and come up with a median price. The easiest (and to some extent over-simplified) way to do this is to grab the selling prices for one product from the top 10 search-engine-driven retailers.

(Please note I am not talking about the top 10 search engine results, since these are blended with non-ecommerce results. Instead, I am talking about using search engine rankings to identify the top 10 retailers for this product, then grabbing the current selling price from each and computing the median value.)

For the example, let’s use the Burton Vapor snowboard. Here are the top 10 retailers for this product based on the query “burton vapor snowboard”:

- Burton.com ($1,199.95)

- Evo.com ($1,199.95)

- Altrec.com ($839.95)

- The-House.com ($839.95)

- Backcountry.com ($1,199.95)

- ProBoardShop.com ($899.95)

- Uncrate.com ($1,200.00)

Ebay.com(Cannot use since this is an active auction.)- Tactics.com ($959.95)

- TruSnow.com ($839.95)

- SkiPro.com ($1,199.95)

So for the Burton Vapor snowboard the median selling price is $1,079.95

Since in this case we are not the manufacturer, but more likely a drop-shipper, we need to calculate our average margin based on our average cost delivered.

Let’s assume we pay median price minus the retail mark-up. As a drop-shipper, let’s say this is 40% based on a minimum order of 1 pallet of 640 parcels, so our cost delivered is $647.97 per unit. This will obviously skew whether we are maintaining local inventory in a shared or wholly owned (or operated) warehouse or if we are drop-shipping depending on the source location of the order.

Now we have a relative measure of vertical market size, our median product selling price, and an approximate product acquisition cost.

We know the following:

- Average monthly search volume of target keyword set: 47,020

- Average median selling price: $1,079.95

And the following are assumptions:

- Average approximate profit margin: 40%

- Approximate product cost: $647.97

- Approximate average profit per sale: $431.98

- Average SERP click-through rate: 6.1%

- Average gross conversion rate: 5%

Now we can project our search-driven revenue.

If 6.1% of 47,020 searches click on our listings, we acquire 2,868 visitors of which 5% will purchase, or 143. This brings in a total of $154,432.85 in revenue and $61,773.14 in profit.

This is a very rough model, especially since this is only half of the equation: the revenue side. To bring this into a more accurate light you need to build a full keyword opportunity model that takes into consideration cost to build and operate your revenue-generating assets (your website, landing pages, and team members) and also carefully consider the offsets to time needed for development and both search engine and PPC optimization.

Conversion-focused keyword research

One of the most important aspects of analyzing which keywords to target is to focus on driving conversions.

For most businesses either moving online or trying to more effectively grow their online revenue channels, it is imperative that you pay attention to revenue generation. You need to look for keyword opportunities that allow you to sell into under-served markets where your products or services closely match shopper needs.

To do this you need to explore searcher intent. There are a few ways to really dive into this but my personal favorite is the approach used by Ted Ives, where he focuses on grouping keywords into semantic funnels to identify intent and even (to an extent) the stage in the buying cycle.

In a nutshell, Ted breaks out some query semantics that can be used to imply intent. For the purposes of this post, I’ll break these up into three groups:

- Research

- Conversion

- Post-Conversion

A research phrase is usually represented by more general non-specific queries consisting of terms related to a product or service, such as “carpet cleaning,” “tire repair,” or “video production software.”

Immediately begin to create returns by driving short-term sales on low-volume items that tend to carry higher profit margins. This is especially important if you are in a vertical where brand and reputation are very important for gaining customers for medium- to high-volume queries.

As searchers move along the conversion funnel you tend to see more description in their search queries, such as the inclusion of brand names, product names, specific criteria, zip codes or postal codes, and city names. Other good signals that a purchase is imminent are common buying keywords like coupon, pricing, cheap, buy, or purchase.

My favorite point from Ted’s post is that he extends the conversion funnel to include post-conversion phrases, which are often overlooked. These are searchers who have already made a purchase but are looking to purchase again, often times telling you they are already a customer in their searches by including words like repair, replacement, add-ons, upgrade, warranty, or support.

Keyword discovery

Accurate keyword discovery is identifying and exploring the happy mediums between high search volume, moderate competition, and acceptable profit margins

Utilizing a proper SEO competitive analysis you will be able to gauge where you competitor weaknesses exist and how to best leverage them. Using Link Detective to sniff the link types from an Open Site Explorer report can quickly provide you with visibility into ranking opportunities.

Once you have identified ranking opportunities and designed a plan of attack it is important to conduct some low-level testing before you go pouring money into an optimization campaign.

Keyword testing

As is the case with everything in SEO, you can never assume your predictions are sound. The only assumption that is 100% true in this industry is that testing always leads to better results.

It is alright to be wrong. In fact, you are almost always going to be wrong when you are getting started. What’s important is to try to limit how wrong you are and for how long. This can be done by taking steps to rein in your assumptions within an order of magnitude (usually within 150% positive or negative).

For me, I have found the best approach to limiting risk from inaccuracies is to run several tests contemporaneously in order to gather actionable data as fast as possible.

One of the first tests I like to run for determining keyword penetration on a few different pages across a few different websites and test for penetration. This is already a relatively long post so stay tuned for an upcoming post on testing new vertical markets for keyword penetration.

Next steps: Moving from analysis to action

Once you have identified your existing vertical markets or new markets that are complimentary to your existing business, you need to take steps to begin acquiring traffic.

First, make sure your on-page SEO is in good shape. Next make sure you are collecting data through an analytics provider and leverage your analytics data to inform your SEO strategy.